The Union Budget 2023 presented in February. The budget was no exception as it rewrapped with old schemes in new avatar. However, finance minister Nirmala Sitharaman has announced five major changes for tax payers.

- Tax rebate limit is raised to ₹7 lakh from ₹5 lakh. The new tax rates are as below.

| Income Slab | Income Tax Rate |

| 0-3 Lakh | Nil |

| 3-6 Lakh | 5% |

| 6-9 Lakh | 10% |

| 9-12 Lakh | 15% |

| 12-15 Lakh | 20% |

| Above 15 Lakh | 30% |

- Changes in Income Tax slab and new rates

- Standard Deduction Rs. 52,500 for salaried person with an income of Rs. 15.5 lakhs or above, and Standard Deduction on pension is Rs. 15000or 1/3rd of pension, whichever is lower.

- Surcharge on Income above 2 crore 25% instead of 37%

- The limit of ₹3 lakh for tax exemption on leave encashment on retirement of non-government salaried employees was last fixed in the year 2002, when the highest basic pay in the government was ₹30,000 pm. In line with the increase in government salaries, I am proposing to increase this limit to ₹25 lakh.

Other than these five announcements, some changes in indirect and direct changes presented as below:

Co-operatives – New co-operatives that commence manufacturing activities till the 31st of March 2024 shall get the benefit of a lower tax rate of 15%.

Green Mobility – Exemptions on excise duty on GST-paid Compressed Biogas have been announced to avoid cascading taxes on blended compressed natural gas.

Electronics Devices – Customs duty on camera lenses and its parts used in the manufacturing of mobile phones has been reduced to zero. Further concessional duty on lithium-ion cells for batteries has been extended for another year.

MSMEs – To support the industry, the budget has enhanced limits for micro-enterprises and certain professionals for availing the benefit of presumptive taxation. Further, the Budget has announced a deduction for expenditure incurred on payments made.

Start-ups – The Budget has extended the date of incorporation for income tax benefits to start-ups. Further, the Budget provides the benefit of carry forward of losses on change of shareholding of start-ups from 7 years of incorporation to 10 years.

Amendments in CGST Act – The Budget has provided an option to amend the CGST Act in order to increase the minimum threshold of tax amount for launching prosecution under GST from 1 crore to 2 crores.

Implications of tax changes – As a result of the changes in the direct and indirect taxes announced in the budget, revenue of close to Rs. 38,000 crores will be foregone while close to Rs. 3,000 croreswill be mobilized.

Some of the 70 exemptions and deductions you won’t get in new regime:

- Leave travel allowance Section 10(5)

- House rent allowance Section 10(13A)

- Children education allowance

- Housing loan interest

- Section 80c investments

- Medical insurance premium U/S 80D

- Expenses actually paid for medical treatment of specified diseases and ailments U/S 80DDB

- Education loan interest U/S 80E

- Rent paid for furnished/unfurnished residential accommodation U/S 80GG

- Deduction in respect of donations to certain funds, charitable institutions U/S 80G

- Interest on deposits in saving account U/S 80 TTA

- Interest on deposits U/S 80 TTB for senior citizens

- Deduction for a certified person with a disability by the medical authority U/S 80 U

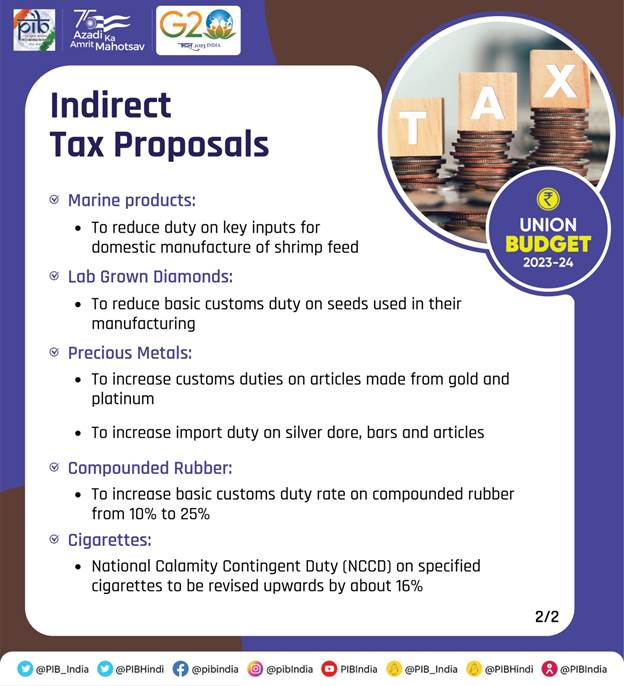

The indirect tax amendments made in budget 2023 to promote exports, encourage domestic manufacturing, enhance domestic value addition and boost green mobility.

The custom duties revised on the following list of items:

- The imported capital goods for lithium-ion battery manufacturing to support green mobility.

- Imported mobile camera lens to add deepening value.

- Denatured ethyl alcohol to benefit the chemical industry.

- Primary inputs for making shrimp feed to increase marine exports.

- Extending the concessional basic customs duty on copper scrap to increase raw material availability for MSMEs.

- Compounding rubber to bring it at par with natural rubber to curb duty circumvention.

- The basic customs duty on the electric kitchen chimneys has been increased.

- The basic customs duty on parts of open cells of TV panels to encourage domestic manufacturing of television.

- Minor changes are carried out in the basic customs duties, cesses and surcharges on certain consumables imported, such as toys, bicycles, automobiles, and naphtha.

GST Changes

- Section 10 stands amended such that a taxpayer can opt into the composition scheme even if they are supplying goods through e-commerce operations where TCS is collected under section 52.

- Section 16 is amended for a condition that in cases where a recipient taxpayer fails to pay to their supplier invoice value including the GST within 180 days from the date of issue of invoice, then they must pay with interest computed under section 50 on it.

- Section 17(5) is revised to include another item under ineligible ITC- Expenditure on CSR initiative for corporate.

- High sea sales and similar transactions neither supply of goods or services are considered exempt and hence ITC proportional to such sales cannot be claimed as per revised section 17(3).

- Sections 37, 39, 55, and 52 are amended to restrict taxpayers from filing GSTR-1 (return for outward supplies), GSTR-3B (summary returns), GSTR-9 (annual returns), and GSTR-8(e-commerce operator) for a tax period after the expiry of three years from the due date.

Furthermore, the budget 2023 proposes amending the CGST Act to increase the minimum tax amount limit for launching a GST prosecution, reducing the compounding amount, decriminalizing certain CGST offences or clauses, etc.

In short, the taxation part is clearly aimed towards simplification and reduction of administrative time of taxpayers, employers as well as the tax authorities on compliance procedures.

(Source: https://www.indiabudget.gov.in and Image Source – PIB)