A credit score is a number that represents how likely you are to pay back the money you borrow. It is calculated based on your past behavior with money, including how much debt you have had and whether or not you paid it back on time.

Credit scores are important because they can affect whether or not someone will give you a loan or line of credit like a credit card. If someone does not want to lend money to someone who has bad credit, they might charge them more interest rates.

Factors that affect credit score

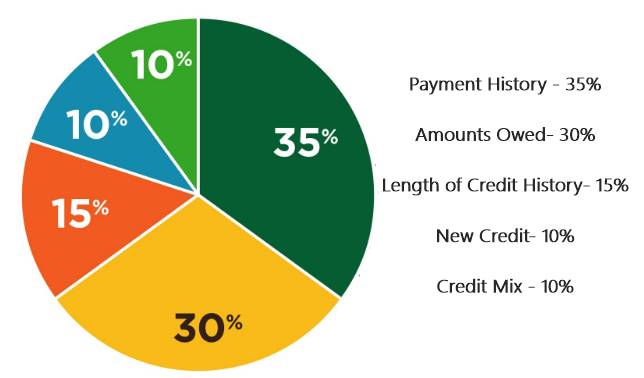

There are five major factors that affect your credit score, and they are:

Payment History

Your payment history is the most important factor in your credit score. It accounts for 35% of your score and includes:

· Payments made on time, including bills such as rent, utilities and credit cards

· Late payments or missed payments (if you are more than 30 days late)

· Bankruptcies, foreclosures and collection accounts

Credit Utilization

Credit utilization is the amount of credit you have available and how much of it you are using. Credit scores look at your total debt, including mortgages, car loans, student loans and credit cards. They also consider how much of that total debt is being used at any given time.

Credit utilization is expressed as a percentage-the higher the number, the more likely it is that you will be considered a risk by lenders because they think there is a chance that you could default on payments or miss them altogether if they give out more money in loans or lines of credit (which would leave those creditors holding bad debt). The lower this percentage is compared with other people who have similar profiles (in terms of age range), income level and length of employment history at current companies/organizations), then better off your score will be overall

Length of Credit History

Length of credit history is the second most important factor in determining your credit score. The longer your credit history, the better your score is. It means that if you are just starting out with a bank account and have never had a loan or card before, it could take some time for lenders to trust you enough to give you one. But once they do, those loans will help build up their confidence in lending money to people like you, and that is good news for everyone involved!

Types of Credit Used

There are several types of credit that affect your credit score. The percentage considered types of credit you are currently using and have used in the past, such as credit cards, home loan, mortgage, car loan, retail account etc.

New Credit

Opening a new credit card, for example, will cause your score to drop.

If you apply for a loan or home loan, it is likely that the lender will check your credit report and score before making their decision. It is a credit check that is done when you apply for new lines of credit, such as a home or car loan. It can lower your score because it indicates that you are looking to obtain more debt. This kind of inquiry is termed as hard inquiry.

Factors that do not affect Credit Score

We have seen what affects credit score and what reasons that contributes to lowering the credit score are. But there are some factors which have no relation with credit score. Hence, it is your call whether to keep them in consideration or not. Let’s see the factors that have absolutely no impact on your credit score.

Your Salary

Though your salary does not have a direct impact on your credit score, it is still important to have a manageable salary to repay your dues and bills.

Where You Live

Whether you live either in an urban area or a rural area is not that important while considering your credit score.

The Rent You Pay

Nobody wants to know how much rent you pay. It is your call how much you want to pay as it is not a factor on which your credit score is relied.

Where You Work

Just as where you live is not so important, where you work is not that significant either. If you have a well maintained and sustainable career, it will be a hand–on benefit, but it won’t have any adverse effects on your credit score.

Your Bank Balance

Your bank balances affect your financial planning if you keep it low, but not on your credit score.

Utility Bill Payments

Your utility bill payment is not an essential factor for credit scoring, but it is your call to keep it due–free for your betterment.

Your Insurance Premiums

In India, insurance premiums are not considered while approving or rejecting a loan or credit card, but timely payment of your premium will help you gain benefit out of your policy.

Your Debit Card Use

Unlike credit cards, debit card usage is not monitored or considered while credit scoring.

Your Spouse’s Credit Score

Credit report is not a joint account, so in case you check your spouse’s credit reports it will not affect your credit score, until/unless you are co–applicant.

Checking Your Credit Score

When you check your own credit report and credit score, it will be considered a soft inquiry as you are doing it to keep yourself up– to–do the mark with your credit score and report. Hence, it will not affect your credit score.

See all these factors are not affecting your credit score or credit report, but it does not mean that you have to ignore these because they might be important in other verticals of your life. So, keeping up–to the mark on these factors will be an additional benefit in maintaining your life hazard–free.

In order to understand your credit score, it is important to understand the factors that affect it and do not affect it.