The dispute over the application of a 28% GST rate to online games has the government and the gaming industry in a contentious standoff, with

The taxation of services between distinct persons in the GST framework has been a subject of uncertainty, sparking debates and discussions. This lack of clarity

The Central Board of Indirect Taxes and Customs (CBIC) is taking steps to address the issue of fake registrations in the Goods and Services Tax

The last date for filing an income tax return (ITR) for FY 2022-2023 is 31st July 2023. However, many people think that they do not

Since its implementation, the Goods and Services Tax (GST) has completely changed India’s indirect tax system. However, many companies have had trouble adhering to the

Beginning on April 1, 2023, the Income-tax Act of 1961 will be amended as proposed in the Budget for 2023. The modifications will take effect

Recently the finance bill 2023 was passed in the Lok Sabha with a total of 64 official amendments proposed in the bill. These will include

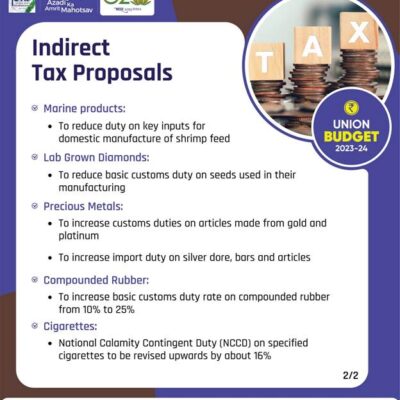

The Union Budget 2023 presented in February. The budget was no exception as it rewrapped with old schemes in new avatar. However, finance minister Nirmala

The Reserve Bank of India has revised instructions in the circular dated on 18th August 2021 for safe deposit locker/safe custody articles to banks to

Though the Union Budget 2022 has no big bang announcement that can draw our eyes towards that, a few measures were taken such as, tax