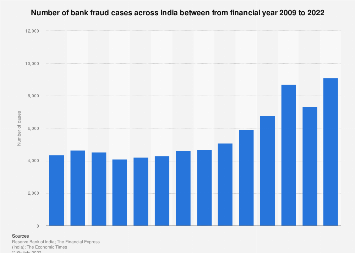

The Reserve Bank India released a report before start of 2023 on banking frauds that has increased in number terms, but the amount involved more than halved in FY 2021-22.

The number of financial frauds rose to 5,406 in the first six months of the financial year 2022-23 compared with 4,069 in the corresponding period a year ago.

The report mentioned that in FY22, banks reported 9,102 frauds involving an underlying amount of Rs 60,389 crore against 7,358 frauds with an amount involved of Rs 1.37 lakh crore in FY21. Banks reported 8,702 frauds entailing Rs 1.85 lakh crore in the pre-pandemic FY20.

“The numbers of frauds reported by private sector banks were mainly on account of small value card/internet frauds, the fraud amount reported by public sector banks was mainly in loan portfolio”, the report added.

The RBI report has shown an assessment of banking group-wise fraud cases over the last three years indicates that while private sector banks reported maximum number of frauds, public sector banks contributed maximum to the fraud amount.

According to the RBI, frauds reported in a year could have occurred several years prior to year of reporting. RBI has added that cash frauds are also on the rise. At ₹18,746 crore, loan-related frauds clocked the biggest share in the first half of FY23, as per RBI data. “Based on the date of occurrence of frauds, advances-related frauds formed the biggest category prior to 2019-20. Subsequently, however, in terms of number of frauds, the modus operandi shifted to card or internet based transactions.

In the first half of the ongoing FY23, the system reported 5,406 frauds involving an underlying amount of Rs 19,485 crore, as compared to 4,069 frauds involving Rs 36,316 crore for the same period in FY21, the report said.

The number of frauds which are related to advances or lending activities has been on a declining trend, with FY22 reporting 1,112 frauds of Rs 6,042 crore, which is lower than 1,477 frauds of Rs 14,973 crore in FY21 and 1,947 frauds of Rs 32,386 crore in FY20, the RBI said in the report on Trend and Progress of Banking in India for FY22.

An analysis of frauds reported during 2020-21 and 2021-22 shows a significant time-lag between the date of occurrence of a fraud and its detection. Around 93.73 percent of the frauds in 2021-22 by value occurred in previous fiscal years as against 91.71 per cent recorded in 2020-21, the RBI said. The number of fraud cases reported by private lenders outnumbered those by public sector banks (PSBs) for the second consecutive year in 2021-22. In terms of the amount involved, however, the share of PSBs was 66.7% in 2021-22, as compared with 59.4% in the previous year.

Due to the increase of online banking and digital payments of the financial ecosystem, cyber security risks for financial institutions are also increasing. Apart from the frauds reported by lenders, the report said there were 3.04 lakh complaints registered by aggrieved customers at RBI Ombudsman offices, as against 3.41 lakh in FY21 and 3.06 lakh in FY20.

In order to have uniformity in reporting, frauds have been classified as under based mainly on the provisions of the Indian Penal Code:

- Misappropriation and criminal breach of trust.

- Fraudulent encashment through forged instruments, manipulation of books of account or through fictitious accounts and conversion of property.

- Unauthorized credit facilities extended for reward or for illegal gratification.

- Negligence and cash shortages.

- Cheating and forgery.

- Irregularities in foreign exchange transactions.

- Any other type of fraud not coming under the specific heads as above.

Nearly 3/4th of the complaints came from urban and metropolitan areas indicating higher awareness levels. A bulk 98.2 percent of the complaints by pensioners was filed against state-run lenders, while private banks led with a 46 per cent share in levy of charges without prior notice.

All RBI authorized Payment System Operators (PSOs)/providers and payment system participants operating in India are required to report all payment frauds, including attempted incidents, irrespective of value, either reported by their customers or detected by the entities themselves. This reporting was earlier facilitated through Electronic Data Submission Portal (EDSP) and is being migrated to DAKSH.

To streamline reporting, enhance efficiency and automate the payments fraud management process, the fraud reporting module is being migrated to DAKSH. The migration was implemented from January 01, 2023 for entities.

(Source: https://www.rbi.org.in/Scripts/NotificationUser.aspx?Id=915&Mode=0)