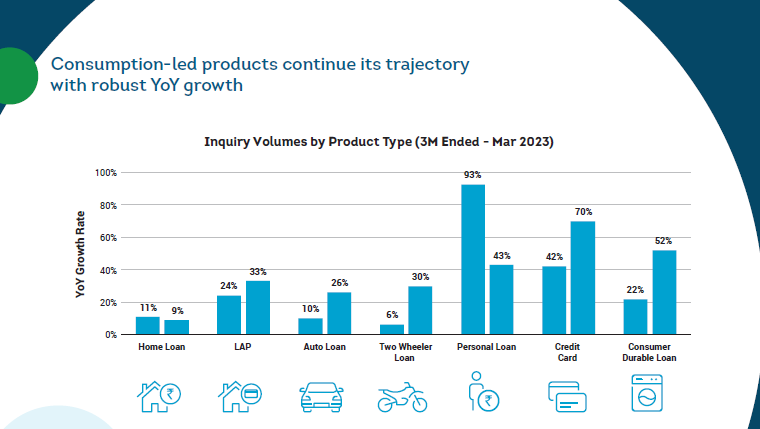

The most recent edition of the TransUnion CIBIL Credit Market Indicator (CMI) report has revealed that credit demand during the quarter ending in March 2023 continued to show strength, with significant growth across almost all product types, except for home loans.

The report highlighted that unsecured credit portfolios have been witnessing a surge, primarily driven by small-ticket loans. Rajesh Kumar, MD and CEO of TransUnion CIBIL attributed this growth to the rise of digital and information-oriented lending, particularly in unsecured consumption-led products, which experienced a remarkable compound annual growth rate (CAGR) of 47 percent from March 2021 to March 2023.

However, the segment that experienced a decline in demand was the affordable housing segment, comprising home loans with a sanctioned amount below Rs 25 lakh. This specific segment observed a year-on-year drop of 16 percent in the number of loan accounts opened and a 15 percent decrease in the sanctioned amount. In contrast, home loans with a sanctioned amount above Rs 25 lakh saw a marginal growth of 1 percent in volume and 6 percent in value terms.

The decline in demand for affordable housing loans was attributed to lenders adopting a cautious approach, mainly due to increasing interest rates and concerns about potential defaults. Rajesh Kumar explained that approval rates for these home loans were lower compared to the same period in the previous year.

Meanwhile, there has been a rise in popularity for sachet-sized financial products, which are smaller loans below Rs 50,000. These products have been instrumental in increasing credit adoption among new-to-credit (NTC) consumers and underserved individuals in semi-urban and rural areas. However, NTC consumers have been experiencing a lower approval rate, decreasing from 34 percent and 28 percent in March 2020 and 2021, respectively, to 23 percent in the quarter ending in March 2023.

Rajesh Kumar believes that there is a significant opportunity to boost financial inclusion, particularly among India’s young population with low credit penetration. To address the challenges associated with the NTC segment, innovative use of technology is being explored to identify patterns of risky behavior and intervene proactively to prevent defaults.

In recent times, data-backed systems powered by machine learning capabilities have facilitated transformations in loan collection approaches for banks, non-banking finance companies (NBFCs), and fintechs. These systems have introduced holistic segmentation, actionable insights, borrower behavioral indicators, and personalized strategies for debt resolution.

Expert emphasized the importance of empowering NTC consumers with personalized financial guidance to prevent defaults and resolve cases amicably.

While retail credit has been on a robust and steady growth trajectory, credit card payment defaults saw a rise in the quarter ending in June 2023. The delinquency rate for credit cards, over 90 days past due, increased by 66 basis points compared to the previous year, reaching 2.94 percent.

Conversely, delinquencies in other credit products have shown improvement, indicating that consumers are managing their credit repayments responsibly. For instance, the delinquency level in consumer durable loans remained relatively flat, with just a 1 basis point increase to 1.46 percent.

An explanation for the increase in credit card defaults could be attributed to the rapidly changing economic scenario, influenced by global challenges in certain sectors and evolving consumer behavior. With the growing popularity of e-commerce and online transactions, consumers have become accustomed to convenient purchases and availing finance, leading to impulsive buying using credit cards and potential lack of financial discipline in repayment.

As of April 21, 2023, the number of unsecured loan payment defaulters in India has risen to 32.9 percent in the personal loans segment, compared to 31.4 percent a year earlier. Factors such as the rising cost of living, job losses, and economic slowdown have contributed to this situation.

Further, the industry expert emphasized the vital role the debt collection industry can play in helping mitigate this situation. Providing solutions to help defaulters repay their debts, such as flexible payment plans and personalized assistance, can help them get back on track financially.

In light of these developments, expert stressed the need for credit card and loan issuers to prioritize responsible lending practices. It is crucial to grant credit limits in alignment with borrowers’ repayment capacity and regularly review them based on the prevailing economic scenarios. Additionally, financial literacy programs should be emphasized to educate consumers about responsible credit card use and the importance of maintaining a healthy financial profile.

In conclusion, while credit demand remains robust for most product types, attention needs to be given to the affordable housing segment and credit card default rates. Implementing technology-driven strategies and focusing on responsible lending practices can ensure sustained and long-term growth in the retail credit market while fostering financial inclusion.

(Source – TransUnion CIBIL CMI for Image Courtesy and Money Control)