If you think of applying for a business loan, irrespective of the amount, lenders or banks will assess your creditworthiness and comprehend whether you are eligible for loan or not. The decision is based on some factors such as your past credit history, loan amount on your company’s name, and more. This creditworthiness is quantified on the basis of CIBIL Rank.

What is CIBIL Rank?

The CIBIL rank summarizes your Company Credit Report in the form of one number.

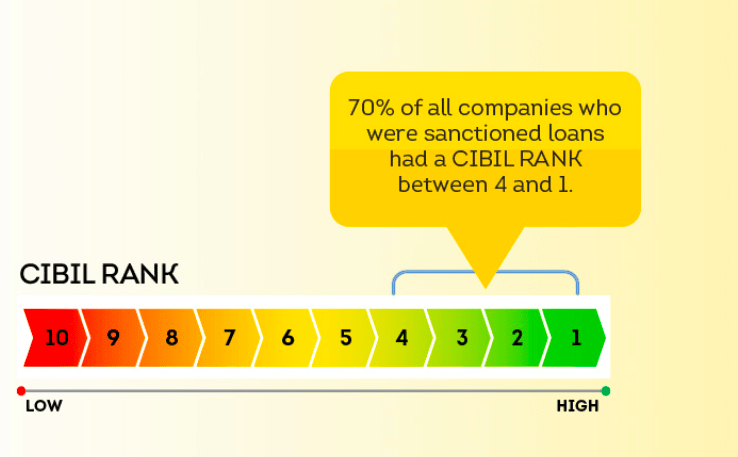

Just as individuals are given a CIBIL Score ranging from 300-900, Companies are assigned CIBIL Rank ranging from 1 to 10 where 1 is best and 10 is worst. However, a CIBIL Rank between 4 and 1 is considered good by most financial institutions.

Most importantly, CIBIL Rank is an indication of a Company’s creditworthiness.

The rank is now available for companies with current credit exposure of up to Rs. 50 crores. Please note that non-availability of CIBIL rank is not a negative thing.

What is CIBIL CCR?

A CIBIL CCR is a record of your company’s credit history. The past payment behavior of a company is a strong indication of its future behavior. It is therefore important to understand that the CCR is heavily relied on by loan providers to evaluate and approve loan applications.

A typical CCR Report comprises the following information:

1 Background Information – The report usually begins by stating the background information of the business, like subsidiary and parent companies, years of operation, ownership, and more.

2 CIBIL Rank – The report then mentions the CIBIL rank of the company, ranging from 1-10.

3 Financial Information – The report includes additional financial details that determine the adequate credit levels that lenders can allow you to borrow.

4 Financial History – The report also covers a brief of financial history, such as collections, repayments, revenue generation, etc

Factors influencing a Commercial Credit Report

- Length of Credit History – Similar to an individual’s credit report, a CCR is also influenced by the length of credit history. Longer the credit history, the better it is for your Company Credit Report.

- Credit Utilization Ratio – CCR of a company works in a manner similar to that of an individual’s. A higher utilization of available credit portrays a company as credit hungry and hence it is considered less creditworthy.

- Repayment History – Companies also have to avail several loans to keep their operations running and have to pay EMIs. Timely payment of an outstanding amount is always good- whether it is a company or an individual.

- Outstanding Debts – The amount of debts outstanding with different credit institutions is taken into account by CIBIL while preparing your CCR. Hence, it is important to maintain only feasible amounts outstanding.

- Size and Life of the Company – Older firms are likely to have better scores on their CCR as compared to start-ups. The reason behind this is that the companies operating for a longer time with continuous growth ought to be more credible as compared to the ones that are smaller and newer.

- Industry – Sometimes, the industry related risks might also have a negative impact on your CCR. For example, real estate is a high-risk industry because of the frequent ups and downs, so the companies that are a part of the real estate industry might be considered less creditworthy than others. Obviously, other factors also count at the time of assigning a CIBIL Rank.

The major parameters that are used to calculate the CIBIL Rank are

- Past Re-payment behavior

- Credit Utilization

What is CIBIL MSME Rank?

CIBIL MSME Rank (CMR) is a credit risk rank for MSMEs that predicts the probability of an MSME becoming NPA in the next 12 months.

CMR is applicable to MSMEs with aggregate commercial borrowings between INR 10 Lakhs and 10 Crores.

CMR is calculated based on 24 months of the MSME’s credit history on the bureau.

CMR is generated using a statistical algorithm which analyzes the last 24 months credit information of a company to generate a rank grade from CMR – 1 to CMR – 10; CMR – 1 denoting the lowest risk and probability of NPA and CMR – 10 denoting the highest risk and probability of NPA.

How is CIBIL MSME Rank calculated?

Pillars of Credit Risk – Entity has the ability to pay back its debt and Entity has the intention to pay back its debt

Parameters to measure credit risk – Liquidity risk of the entity -Firmographic profile of the entity and Poor past repayment behavior

How to enhance CIBIL Rank or CIBIL MSME Rank?

To improve both of these aspects, you would first have to comprehend the factors that can impact your rank and CCR. Below are some points that can help you enhance the overall ranking of your company:

- The loan taken by you should be in the name of your company. However, make sure that you don’t Default any payment.

- Pay EMIs of your credit card’s outstanding debt on time.

- Stay cautious of every transaction going from your or the company’s card so that the mistakes, if arising, could be rectified on time.

- Don’t exhaust your Credit Limit and take a loan only when you can pay back.

- Taking long-term debts and paying on time can reflect positively on your rank.

Apart from CIBIL, there are other credit bureaus Equifax, Experian and CRIF High Mark that also provide detailed credit reports to the companies, just like they do for individual members. While this is a generic report format, it may differ from one Credit Information Company to another. However, the report generated by all bureaus is based on the information procured from banks and is as reliable as the CIBIL CCR.